Why TTV is Emerging as the Key Oracle Metric

Oracles bridge blockchains with the real world. Without them, blockchains would be static ledgers with built-in logic unable to interact with external data. As the design space of decentralized applications (dApps) has grown, oracles have evolved to meet new demands. On-chain data has become more diverse and secure, while the time to put data on-chain has reduced by orders of magnitude, significantly reducing latency.

Pushing data on-chain began in 2012, and started unlocking a plethora of use cases beginning in 2017, accelerating during DeFi summer in 2020. Initially, oracles began with simple use cases like powering liquidation engines for lending protocols like Aave and Compound, but they continued evolving. They began supporting automated investment vaults (Stake DAO), Collateralized Debt Position (CDP) protocols (MakerDAO), and eventually, Perpetual Futures Decentralized Exchanges (Perp DEXs) such as dYdX, GMX, Hyperliquid, Vertex, and Helix.

Decentralized Finance (DeFi) has long been positioned as an inevitable challenger to traditional finance (TradFi), particularly in trading, investing, and payments. To challenge TradFi and Web2, crypto has relentlessly pursued faster transaction speeds and increased throughput. One thing is clear: to power finance, the greatest product-market fit crypto has found, we need robust, scalable infrastructure. Eventually, crypto is expected not only to replace TradFi and web 2, but to improve them.

But to fully realize its potential, crypto needs oracles that are not only secure but agile, low-latency, and capable of supporting high transaction volumes. As the space matures and unlocks new use cases and financial primitives, we must rethink how we evaluate the impact and effectiveness of oracles. Not all oracles are created equal; they differ in how they secure capital, the speed at which they operate, and the volume of transactions they handle.

TVS and the Problem

As oracles evolve to meet the growing demands of DeFi, accurately measuring their impact remains a challenge. While qualitative factors such as security, data reliability, and decentralization play a role, the industry has gravitated toward quantitative metrics to assess an oracle’s significance. Among these, the most widely used is Total Value Secured (TVS).

“TVS = Sum of TVL of all protocols secured by an oracle”

TVS focuses on the amount of assets that an oracle secures across all the protocols using that oracle. For instance, if there is $10B in collateral in a lending protocol, it adds $10B to the TVS of the oracle used by the lending protocol. By summing up the total value locked (TVL) for each protocol using an oracle service, we arrive at that oracle’s TVS.

“If protocols use an oracle to secure large amounts of value, the intuitive conclusion is that the oracle must be trusted and reliable, right?”

While TVS seems like an obvious metric to measure the impact of oracles, this has proved to be insufficient by itself as the industry has continued innovating and maturing. TVS fails to capture a key piece of the puzzle: the value provided by oracles when there is a lot of transactional throughput, even if the value being “secured” isn’t that high. For instance, in some Perp DEXs, there may be extensive trading volume from a continuous number of positions opening and closing, but not necessarily a large static collateral pool.

"TVS is like a still photograph of a bank vault full of cash that captures a moment in time. It shows the static amount of secured capital but doesn't reveal anything about the ongoing hustle and bustle of daily transactions, and how that cash is actually used"

TVS is certainly still very relevant for OG DeFi protocols like lending protocols or investment-vault-type products, where a user is likely not transacting as regularly as with something like a Perp DEX. User funds generally sit in a smart contract for long periods, resulting in a large, static capital base. In other words, TVS is a metric relevant to more static DeFi protocols and cannot really capture the frenetic pace at which transactions themselves are secured by Perp DEXs. At such venues, the transaction volumes generally dwarf the capital base in question, and each transaction requires an oracle to provide low-latency data for high-frequency transactions.

Drawbacks of TVS

As DeFi protocols evolved, it became clear that TVS was only part of the story. TVS’ pitfalls are listed below.

Measures capital at risk, not activity

TVS is essentially a snapshot of the value secured by an oracle; put in another way, it measures how much capital could be at risk if an oracle malfunctions or is attacked. While this was an important way to think about oracles at the infancy of DeFi, when protocols used a single oracle source and oracle failure posed systemic risk.

Today, however, most protocols use multiple oracles and oracles use multiple sources of data to avoid this very scenario. It overlooks how often an oracle’s data is actually called upon to facilitate transactions over a time period, and how oracles generate revenue or justify integration fees.

Ignores High-Frequency Protocols

A major chunk of DeFi activity today takes place through DEXs offering Perps. As on-chain derivatives activity rises at an exponential pace, there is massive transaction volume flowing through Perp DEXs. The amount of value locked is generally relatively small compared to the sheer transaction volume. TVS does not capture that intense activity.

TVS does not capture the intensity of oracle usage in these environments. A Perp DEX might facilitate billions in daily trading volume, relying on rapid, low-latency price updates, yet contribute relatively little to an oracle’s TVS because of its smaller collateral pool.

Distortions in Market Share

Relying solely on TVS to gauge oracle “dominance” can misrepresent actual usage. A protocol with modest TVL but extremely high daily trading volume can contribute far more in practice to an oracle’s usage than a protocol with large locked collateral but few transactions.

For instance, if a lending protocol has $1 billion in TVL and a Perp DEX has $50 million in TVL, the lending protocol may only process hundreds of transactions a day, while the Perp DEX may process millions of transactions. TVS fails to capture this demand for an oracle’s price data.

How TTV Fills the Gap

“If TVS is the visible tip of an iceberg, TTV represents the massive, dynamic underwater portion, the hidden activity that truly drives value.”

While TVS stays relevant in the context of static OG DeFi protocols, it unfortunately cannot capture the value oracles provide to the dynamic, fast-paced protocols of today. In a fast-paced DeFi landscape, a better metric is needed—one that reflects how often and how intensely an oracle is used.

To capture the value provided by oracles to such protocols, Total Transaction Volume (TTV) is a better solution. Total Transaction Volume (TTV) addresses this gap by measuring the cumulative transaction volume facilitated by an oracle over a certain period.

“TTV sums up all the value of all transactions facilitated by an oracle.”

By tracking TTV, protocols and stakeholders can gain deeper insights into real oracle usage, revenue potential, and technical capabilities.

Real Usage and Market Demand for Oracle Data

TTV tracks the frequency and the intensity with which a protocol’s participants rely on the oracle service underpinning the protocol’s products. If $500M is traded daily on a perp DEX, the oracle secures $500M of daily activity, not just a one-time collateral snapshot. This activity can be captured using TTV. This better reflects an oracle’s actual role in securing economic activity.

Oracle Revenue Potential

Many oracles collect fees per update or have subscription models based on usage frequency. A protocol that makes thousands of price calls per day represents a larger revenue driver than one with a high static TVL but fewer updates. Thus, TTV also reflects market share in the oracle industry better than just using TVS can.

Technical Capabilities of an Oracle

Speed, throughput, and real-time data are now central to DeFi activity. TTV aligns directly with these next-generation demands, showing which oracles can handle:

- Sub-second price updates- High-frequency trading- Institutional-grade data feeds

Stork’s oracles, for instance, specialize in offering sub-second low-latency data feeds for all kinds of assets, including long-tail assets. Stork tends to offer such products faster than the competition and thus keeps up with the intense pace of trading by retail and algorithmic/institutional players while also bringing products to market fast, vetting the appetite of the market to trade new assets being created at a breakneck pace.

Unfortunately, despite its advantages, TTV is significantly more challenging to measure accurately.

- Oracles do not publicly share transaction volume data.

- Some protocols use multiple oracles for redundancy, making it unclear which oracle facilitated which portion of the volume.

- Only oracles themselves have precise TTV figures, making external estimations challenging.

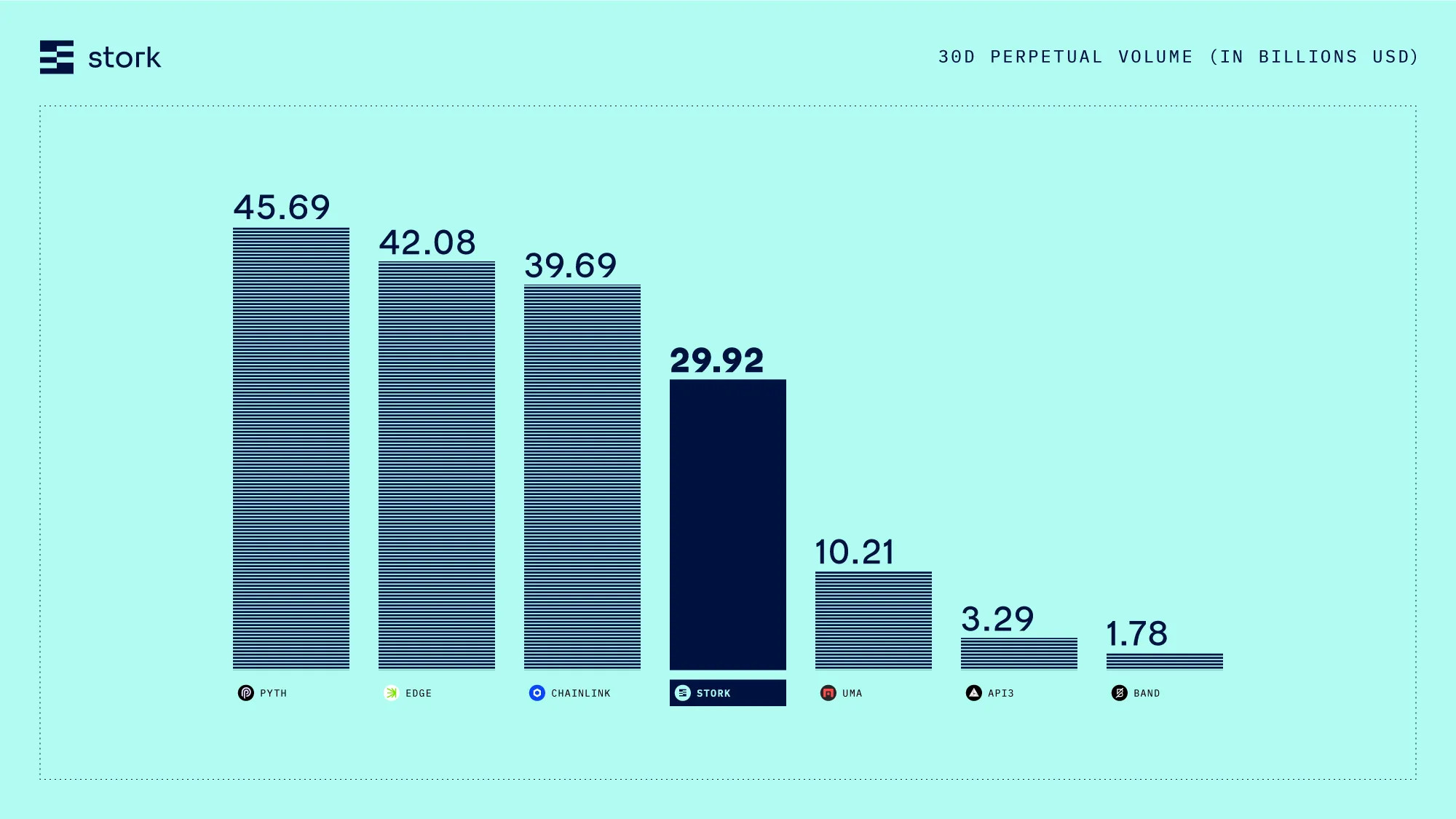

However, approximate TTV estimates can still provide valuable insights into oracle usage. By leveraging public trading volume data from Perp DEXs, we can estimate TTV figures and paint a more realistic picture of oracle dominance.

Closing Thoughts

The “Total Value Secured” metric has not kept pace with the fast-evolving DeFi landscape. The static TVS is no longer enough to measure an oracle’s impact and may in fact be misleading, skewing heavier towards oracles that secure lending protocols or invest-vault-type products. While TVS remains a valid consideration, especially for gauging worst-case security risk, it fails to reflect the increasingly dynamic, high-throughput realities of modern DeFi.

TTV is a more holistic metric than TVS because it reflects the actual demand for price updates from an oracle, while TVS only reflects the amount of assets committed to a smart contract that uses a particular oracle. TVS, unfortunately, does not accurately represent the real-world demand from the market as the demand for price updates varies across different DeFi protocols, depending on the type of protocol.

“If TVS is a snapshot, TTV is a live stream.”

TTV also highlights the competitive advantages of highly capable oracles. Lifinity, an automated liquidity provision protocol on Solana, is able to offer orders of magnitude better yield to their users than standard Liquidity Pools by building a custom oracle that is used to rebalance automated market maker (AMM) pools. While the TVL of Lifinity is paltry compared to other protocols, its active yield management strategy leads to a very high TTV, all powered by its custom in-house oracle. Hyperliquid, a perp DEX, is able to offer a trading experience on par or even better than a centralized exchange, in part due to its excellent custom oracle feeds that go live almost instantly after an asset is launched. Stork’s TTV, for a 30d period, is 136x higher than its TVS because Stork has a competitive advantage in low-latency oracles, combined from on and off-chain oracles. Industry giants like Chainlink and Pyth soon followed suit with similar products, “Data Streams” and “Pythnet” respectively.

As the industry matures and keeps moving toward speed, throughput, and scalability to improve user experience, TTV is a better lens to gauge an oracle's impact on the industry. To realize the goal of replacing TradFi and making it better, TTV is certainly a very important metric. If the world is to come on chain, and entities like NASDAQ and Visa are to be subsumed by crypto, TTV is the metric to pay attention to.

As highlighted above, a lot of DeFi activity gets propelled by increased innovation and capability in oracle infrastructure; additionally, these changes in oracle infrastructure also facilitate innovation and the creation of new primitives, helping DeFi accelerate beyond TradFi in terms of a feature set.